大黄蜂科技Bumblebee technology

2019I China cross-border retail e-commerce policy

Interpretation and Solutions

2019 I 中国跨境零售电商政策

解读和解决方案

中国跨境零售电商简史

History of Cross-border Retail E-Commerce in China

01私人代购时代

流程:

留学生海\外旅居者 —— 专柜购买 —— 自带或转运公司或国际快递交付

(个人物品类报关避税)

问题:到货周期长、缺少售后服务、质量保障问题、代购者因避税&无证经营带来的法律问题。2019年1月1日起,因为新电商法已是非法主体

01 Time of private overseas shopping on behalf

Process:

Overseas student\overseas resident ——buy in-store —bring back or delivery by shipping company or international express delivery

(go through the process of customs declaration)

Problem:Long delivery period, lack of after-sales service, quality assurance problems, legal problems caused by tax avoidance and unrecorded operation of purchaser. Start from January 1, 2019, the new e-commerce law states that private overseas shopping on behalf has become an illegal。

02海淘时代

流程:

通过内容分享或社区作为流量 —— 消费者采购 —— 导流者拿返佣或者商品差价

入口将消费者导流至海外平台

问题:对消费者要求高(如语言、支付方式)、物流的时间成本高、售后服务无法实现等。2019年起,因为以上问题,会逐步边缘化

02 Overseas online shopping

Process:

Use content link sharing or community as flow —– consumer purchase —- divert consumers to overseas online shopping platform through commissions or commodity differentials

Problems: High requirements for consumers (such as language, payment method), time cost of logistics, failure to achieve after-sales service, etc. Start from 2019, these problems will be gradually marginalized.

03跨境电商时代

流程:

消费者通过平台下单 —— 平台备货 —— 通过集邮保税模式快速交付货物

好处:更便捷、更高效、更透明。2019年1月1日起,受政策鼓励,进入大规模发展阶段

虽然,这几种演变、并存的商业模式都满足了人民日益增长的物质文化需求,但是很显然B2C跨境模式

从消费体验售后服务、法律风险、税收、海关管理、国际收支等各方面都好过前两者.

03 Cross-border E-commerce Era

Process:

Cusumers place order online —- Platform Stocking —–Fast Delivery of Goods by Stamp Collection Bonded Mode

Benefits: More convenient, high efficient and transparent. encouraged by policies since January 1, 2019, it entered a stage of large-scale development.

Although these evolving and coexisting business models meet the growing material and cultural needs of the people, it is clear that the B2C cross-border mode is much better than the former two in the aspects of consumer experience, after-sales service, legal risk, taxation, customs administration, balance of payments,etc.

2019新电商法和跨境新法规

2019 New E-Commerce Law and Cross-border e-commerce Regulations

跨境电商时代Cross-border e-commerce era

1. 自2019年1月1日起,延续实施跨境电商零售进口现行监管政策,对跨境电商零售进口商品不执行首次进口许可批件、注册或备案要求,而按个人自用进境物品监管。Since January 1, 2019, the current regulatory policy on cross-border e-commerce retail imports would continue. The first import licensing, registration or record are not implemented for cross-border e-commerce retail imports, but regulated as personal imported articles.

2. 将政策适用范围北京、天津、上海、唐山、呼和浩特、沈阳、大连、长春、哈尔滨、南京、苏州、无锡、杭州、宁波、义乌、合肥、福州、厦门、南昌、青岛、威海、郑州、武汉、长沙、广州、深圳、珠海、东莞、南宁、海口、重庆、成都、贵阳、昆明、西安、兰州、平潭等37个城市(地区)的跨境电商零售进口业务。The policy will apply to Cross-border e-commerce retail import business in 37 cities (regions) including in Beijing, Tianjin, Shanghai, Tangshan, Hohhot, Shenyang, Dalian, Changchun, Harbin, Nanjing, Suzhou, Wuxi, Hangzhou, Ningbo, Yiwu, Hefei, Fuzhou, Xiamen, Nanchang, Qingdao, Weihai, Zhengzhou, Wuhan, Changsha, Guangzhou, Shenzhen, Zhuhai, Dongguan, Nanning and Haikou, Chongqing, Chengdu, Guiyang, Kunming, Xi’an, Lanzhou and Pingtan, etc.

3. 对《跨境电子商务零售进口商品清单》内的商品实行限额内零关税、进口环节增值税和消费税按法定应纳税额70%征收基础上,进一步扩大享受优惠政策的商品范围,新增消费者需求量大的63个税目商品。On the basis of levying zero tariff within the quota, 70% of value-added statutory tax and consumption statutory tax on commodities from import links according to the List of Retail Import Commodities of Cross-border Electronic Commerce, the scope of commodities enjoying preferential policies has been further expanded, additional 63 items of taxable commodities with large consumption demand have been added.

4. 提高享受税收优惠政策的商品限值上限,将单次交易限值由2000元提高至5000元,将年度交易限值由每年2万元提高至2.6万元。Increase the cap on preferential tax policy commodity limits , raise the cap on single transaction from 2,000 yuan to 5,000 yuan, and raise the cap on annual transactions from 20,000 yuan to 26,000 yuan.

5. 按照国际通行做法,支持跨境电商出口,研究完善相关出口退税等政策。In accordance with international practices, support cross-border e-commerce exports , study and improve relevant export tax rebate policies.

6. 依法加强跨境电商企业、平台和支付、物流服务商等责任落实,强化商品质量安全监测和风险防控,维护公平竞争市场秩序,保障消费者权益。Legally strengthen responsibility implementation of cross-border e-commerce enterprises, platforms and payment, logistics service providers, strengthen commodity quality and safety monitoring and risk prevention, safeguard fair competition market order, safeguard consumer’s rights and interests.

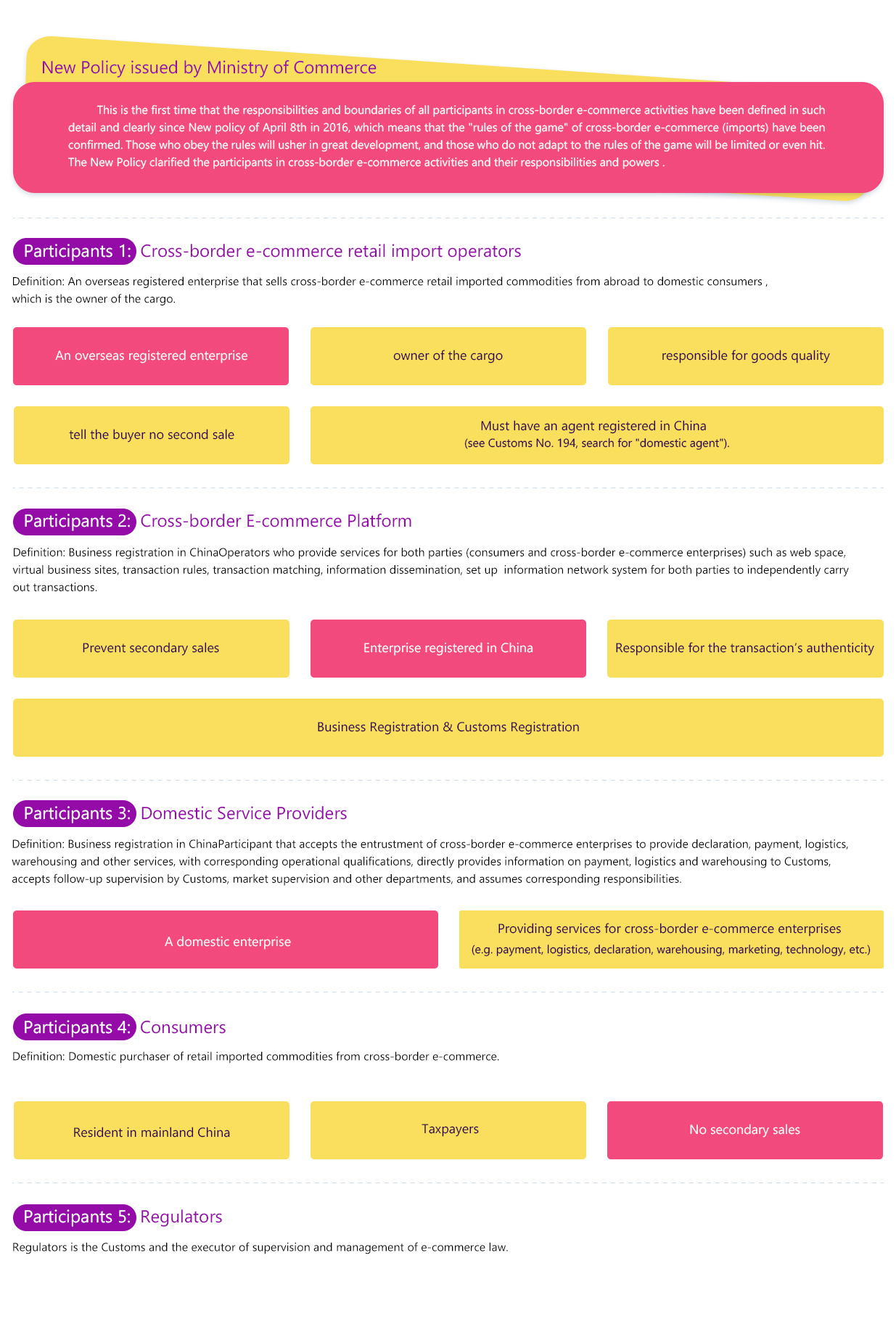

商务部新政落地New Policy issued by Ministry of Commerce

这是2016年四八新政以来,第一次如此详细的对跨境电商活动的各个参与方的职责和边界进行定义,定义清晰了,就意味着跨境电商(进口)的“游戏规则”确认了,适应游戏规则的将迎来大发展,不适应游戏规则的会被限制甚至打击。新政明确了跨境电商活动的参与主体、主体的责任和权力。

This is the first time that the responsibilities and boundaries of all participants in cross-border e-commerce activities have been defined in such detail and clearly since New policy of April 8th in 2016, which means that the “rules of the game” of cross-border e-commerce (imports) have been confirmed. Those who obey the rules will usher in great development, and those who do not adapt to the rules of the game will be limited or even hit. The New Policy clarified the participants in cross-border e-commerce activities and their responsibilities and powers .

参与主体1:跨境电商零售进口经营者

定义:自境外向境内消费者销售跨境电商零售进口商品的境外注册企业,为商品的货权所有人。

Participants 1: Cross-border e-commerce retail import operators

Definition: An overseas registered enterprise that sells cross-border e-commerce retail imported commodities from abroad to domestic consumers , which is the owner of the cargo.

是一家境外企业An overseas registered enterprise 是贷权所有人owner of the cargo

要对商品质量负责responsible for goods quality 要告知买家不准二次销售tell the buyer no second sale

要有一家境内注册的公司作为代理人(看海关的194号文,搜索“境内代理人”)

Must have an agent registered in China (see Customs No. 194, search for “domestic agent”).

参与主体2:跨境电商平台

Participants 2: Cross-border E-commerce Platform

定义:在境内办理工商登记Definition: Business registration in China

为交易双方(消费者和跨境电商企业)提供网页空间、虚拟经营场所、交易规则、交易撮合、信息发布等服务,设立供交易双方独立开展交易活动的信息网络系统的经营者。

Operators who provide services for both parties (consumers and cross-border e-commerce enterprises)

such as web space, virtual business sites, transaction rules, transaction matching, information dissemination, set up information network system for both parties to independently carry out transactions.

防止二次销售Prevent secondary sales 是一家境内企业 Enterprise registered in China

对交易真实性负Responsible for the transaction’s authenticity

工商注册&海关登记Business Registration & Customs Registration

参与主体3:境内服务商

Participants 3: Domestic Service Providers

定义:在境内办理工商登记Definition: Business registration in China

接受跨境电商企业委托为其提供申报、支付、物流、仓储等服务,具有相应运营资质,直接向海关提供有关支付、物流和仓储信息,接受海关、市场监管等部门后续监管,承担相应责任的主体。

Participant that accepts the entrustment of cross-border e-commerce enterprises to provide declaration, payment, logistics, warehousing and other services, with corresponding operational qualifications, directly provides information on payment, logistics and warehousing to Customs, accepts follow-up supervision by Customs, market supervision and other departments, and assumes corresponding responsibilities.

是一家境内企业 a domestic enterprise 为跨境电商企业提供服务(如支付、物流、申报、仓储、营销、技术等)

Providing services for cross-border e-commerce enterprises (e.g. payment, logistics, declaration, warehousing, marketing, technology, etc.)

参与主体4:消费者 Participants 4: Consumers

定义:跨境电商零售进口商品的境内购买人。

Definition: Domestic purchaser of retail imported commodities from cross-border e-commerce.

中国大陆居民Resident in mainland China 是纳税义务人taxpayers 不得二次销售no secondary sales

参与主体5:监管方Participants 5: Regulators

监管方即海关,电商法监督管理执行方。

Regulators is the Customs and the executor of supervision and management of e-commerce law.

商法和跨境新法规Commercial Law and New Cross-border Regulations

一句话:个人代购已违法,企业资质往B2C上面靠!

On word: private overseas shopping on behalf is illegal, enterprise qualifications go towards B2C!

我是平台——————自营————————海外公司采购

I am the platform ———— self-owned business ——overseas company purchase

交易真实True transaction,三单合规triple compliance

税务合规Tax compliance

入驻settle in———供货商入驻 goods suppliers settle in———pick up goods from overseas supplier’向平台海外主体提货

商驻家入,面向C端销售——税务合规Business settle in, C-End Sales—–Tax Compliance

资质合规Qualification compliance

向平台海外主体供货Supply goods to overseas platform

无法结汇至海外Unable to remit to overseas

海外公司统一采购货品 Overseas company central purchase

如何合法合规?—————我是海外货主————建立国内公司————国内公司海关备案、合规

利用公众号、小程序、网站等创建B2C商城

招募代购、分销商

自营招揽顾客下单

结汇至海外公司

自建海外B2C网站——顾客下单

委托物流和清关

保税直邮国内

提货给国内平台的海外主体统一采购

How to comply legally? —— I am an overseas cargo owner——set up a domestic company—— register with the customs and compliance

Creating B2C Mall with Public Number, mini Program, Website, etc.

Recruiting agents and distributors

Solicit Customers to Place Orders

Remittance to Overseas Companies

Built up Overseas B2C Website——-customer place order

Entrusted Logistics and Customs Clearance

Bonded Direct Mail to China

Take delivery of goods to domestic platform of overseas central purchase

我是代购、分销商——个人———————传播合规平台商品页面、小程序等、获取销售提成

不可向顾客收款——————违法

企业———————入驻平台,帮助分销,获取提成

公司资质,需要纳税

没有海外商品货权,无海外公司

无法结汇至海外

I am a purchase agent, distributor—-individual——-receive sales commission by sharing commodity pages, mini program, etc.

Can not receive payments from customers——illegal

Enterprise —— settle in platform, Help distribution, get commission

Company qualifications, tax payment

No ownership of overseas merchandise, no overseas companies

Unable to remit overseas

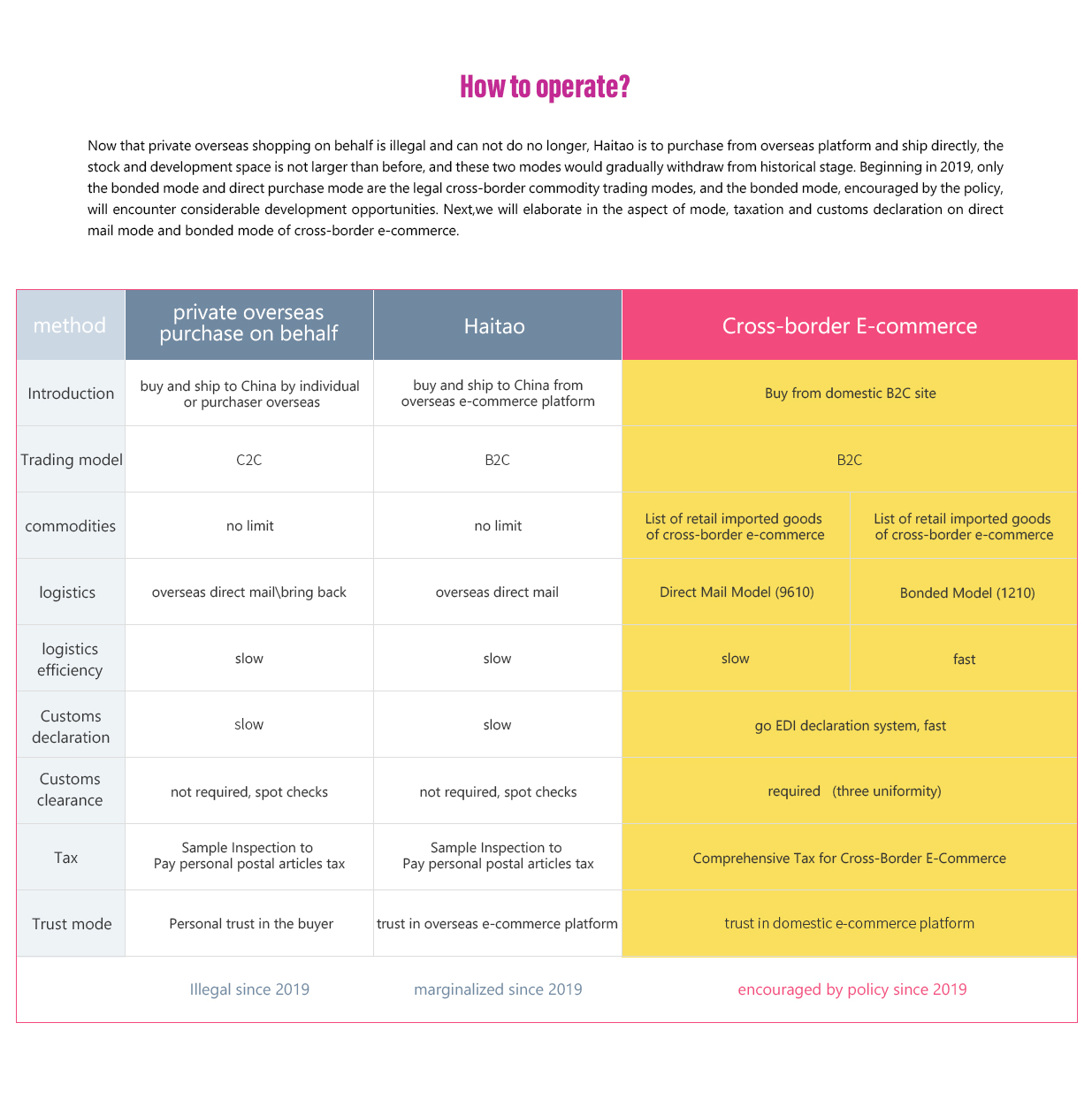

如何实际操作?How to operate?

目前个人代购因为主体不合法,已经不能做了;海淘是海外平台购买发货,走行直邮模式,因为存量和可发展空间不大,这两者会逐步退出历史舞台。2019年开始,符合法律的跨境商品交易模式就只有保税模式和直购模式了,而保税模式受到政策鼓励,将会遇到长足的发展机遇。下面将从模式、税收、报关等角度来详解跨境电商的直邮模式和保税模式。 Now that private overseas shopping on behalf is illegal and can not do no longer, Haitao is to purchase from overseas platform and ship directly, the stock and development space is not larger than before, and these two modes would gradually withdraw from historical stage. Beginning in 2019, only the bonded mode and direct purchase mode are the legal cross-border commodity trading modes, and the bonded mode, encouraged by the policy, will encounter considerable development opportunities. Next,we will elaborate in the aspect of mode, taxation and customs declaration on direct mail mode and bonded mode of cross-border e-commerce.

方式method 代购 private overseas purchase on behalf 海淘 Haitao 跨境电商cross-border e-commerce

Introduction buy and ship to China by individual or purchaser overseas buy and ship to China from overseas e-commerce platform Buy from domestic B2C site

购买海外商品并寄回国内 由电商网站寄回国内

Trade mode C2C B2C B2C

commodities no limit no limit list of zero

List of retail imported goods of cross-border e-commerce . 跨境电子商务零 跨境电子商务零

List of retail imported goods of cross-border e-commerce . 售进口商品清单 售进口商品清单

物流方式 logistics 海外直邮\人肉带回overseas direct mail\bring back 海外直邮overseas direct mail 直邮模式(9610)Direct Mail Model (9610) 保税模式(1210)Bonded Model (1210)

物流时效logistics efficiency 慢 slow 慢 slow 慢 slow 快fast

通关速度 慢 慢 走海关通关EDI申报系统,快

Customs declaration slow slow go EDI declaration system, fast

清关 不报关、抽查 不报关、抽查 需要报关(三单对碰)

Customs clearance not required, spot checks not required, spot checks required (three uniformity)

税收 抽检到缴纳行邮税 抽检到缴纳行邮税 跨境电商综合税

Tax Sample Inspection to Pay personal postal articles tax Sample Inspection to Pay personal postal articles tax Comprehensive Tax for Cross-Border E-Commerce

信任模式 对代购者个人的信任 对海外电商平台的信任 对境内电商平台的信任

Trust mode Personal trust in the buyer, trust in overseas e-commerce platform trust in domestic e-commerce platform

2019起已违法 2019起边缘化 2019起政策鼓励

Illegal since 2019 marginalized since 2019 encouraged by policy since 2019

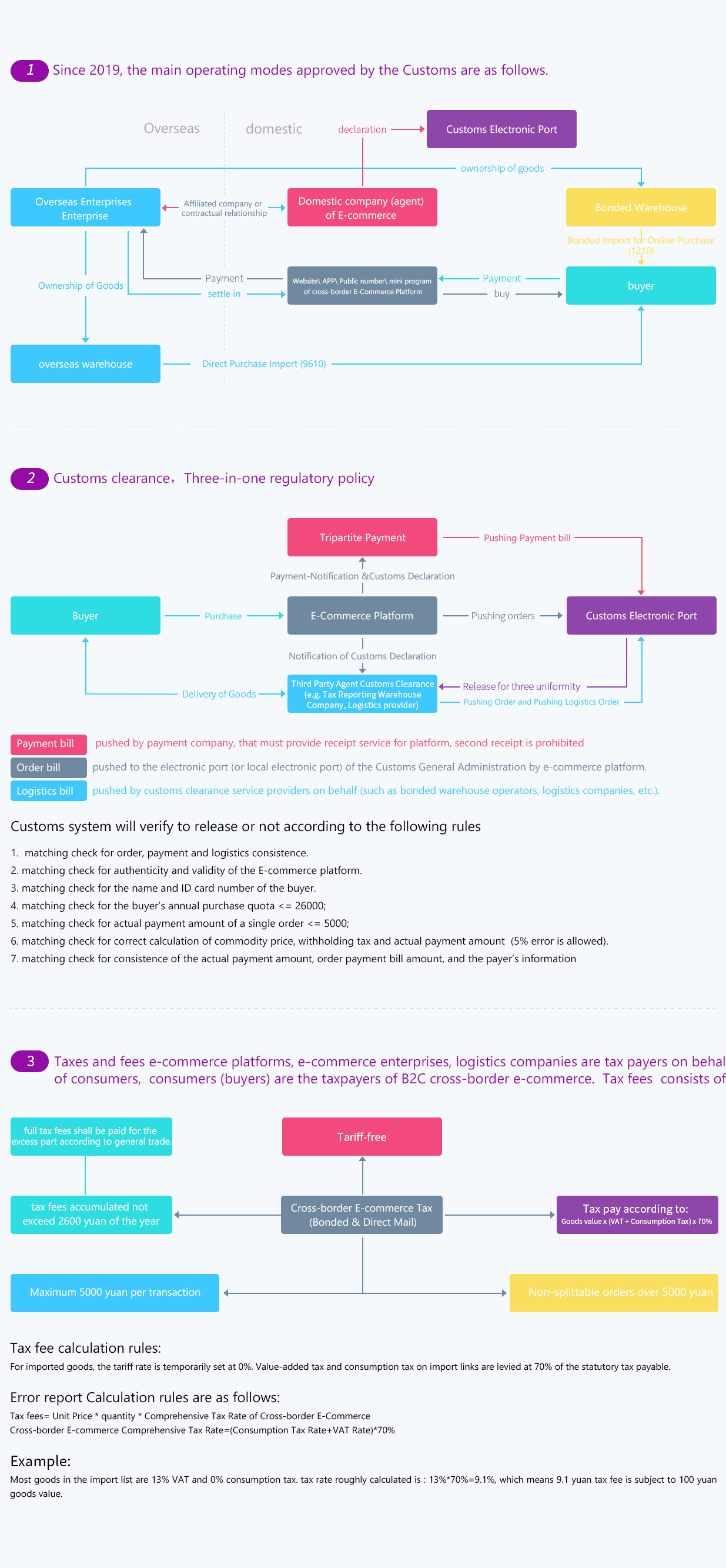

1、 2019年起,受海关认可的主要运营模式如下

Since 2019, the main operating modes approved by the Customs are as follows.

境 外 境 内 申报———— 海关电子口岸

Overseas domestic declaration——Customs Electronic Port

———————————————————————————— 货权归属 ownership of goods ——————— 商企业境外主体 ————关联公司或合同关系———— 电商企业(代理人)境内主体 保 保税仓

网购保税进口(1210)

Overseas Enterprises—– Affiliated company or contractual relationship——-Domestic company (agent) of E-commerce Enterprise Bonded Warehouse

Bonded Import for Online Purchase (1210)

————支付 Payment———— ——————支付 payment————

货权归属 ——————入驻————网站 \ APP \ 公众号 \ 小程序 跨境电商平台——————购买———— 买 家

Ownership of Goods ——-settle in——Website\ APP\ Public number\ mini program of cross-border E-Commerce Platform —— buy——– buyer

海外仓 overseas warehouse———————直购进口(9610)Direct Purchase Import (9610)—————————

2、 清关流程 Customs clearance

三单合一监管政策:Three-in-one regulatory policy

————支付&通知报关———— 三方支付 —————推送支付单————

买 家 ——————购买————— 电商平台 ——————————推送订单—————————— 海关电子口岸

三单一致通知放行

——通报报关—— 第三方代理清关公司

———————————货物配送————————————(如报税仓公司、物流公司)——推送订单推送物流单——

———— Payment-Notification &Customs Declaration—-Tripartite Payment——Pushing Payment bill————

Buyer—–Purchase——-E-Commerce Platform———Pushing orders————-Customs Electronic Port

Release for three uniformity

—— Notification of Customs Declaration —— Third Party Agent Customs Clearance

———Delivery of Goods (e.g. Tax Reporting Warehouse Company, Logistics provider) – Pushing Order and Pushing Logistics Order——

支付单:支付公司负责推送,但是该支付公司必须直接为平台提供收单服务,严禁二次收单。

订 单:订单由电商平台对接推送至海关总署电子口岸(或当地电子口岸)。

物流单:由清关服务商代为推送(如保税仓运营方、物流公司等)。

Payment bill: pushed by payment company, that must provide receipt service for platform, second receipt is prohibited

Order bill: pushed to the electronic port (or local electronic port) of the Customs General Administration by e-commerce platform.

Logistics bill : pushed by customs clearance service providers on behalf (such as bonded warehouse operators, logistics companies, etc.).

海关系统会按照以下规则对信息进行校验,确认是否放行

1.订单、支付单、物流单匹配一致;

2.电商平台、电商企业备案信息真实有效;

3.订购人姓名、身份证号匹配查验一致;

4.订购人年度购买额度<=¥26000;

5.单笔订单实际支付金额<=¥5000;

6.订单商品价格、代扣税金、实际支付金额等计算正确(允许5%误差);

7.订单实际支付金额与支付单支付金额、支付人信息等一致。

Customs system will verify to release or not according to the following rules

1. matching check for order, payment and logistics consistence.

2. matching check for authenticity and validity of the E-commerce platform.

3. matching check for the name and ID card number of the buyer.

4. matching check for the buyer’s annual purchase quota <= 26000;

5.matching check for actual payment amount of a single order <= 5000;

6. matching check for correct calculation of commodity price, withholding tax and actual payment amount (5% error is allowed).

7. matching check for consistence of the actual payment amount, order payment bill amount, and the payer’s information

3、 税费 Taxes and fees

电商平台、电商企业、物流公司为消费者代扣代缴、B2C跨境电商的纳税主体是消费者(订购人),税费构成如下:

e-commerce platforms, e-commerce enterprises, logistics companies are tax payers on behalf of consumers, consumers (buyers) are the taxpayers of B2C cross-border e-commerce. Tax fees consists of

————全年累计不超过26000元 超过后按照一般贸易全额征税

————单次交易最高5000元

跨境电商税费 (保税&直邮) ————不可拆分超过5000元的订单

————免关税

————按照:货值x(增值税+消费税)x70%收取税费

---------------tax fees accumulated not exceed 2600 yuan of the year, full tax fees shall be paid for the excess part according to general trade.

--------Maximum 5000 yuan per transaction

-------Tariff-free

--------Tax pay according to: Goods value x (VAT + Consumption Tax) x 70%

税费计算规则Tax fee calculation rules:

进口商品,关税税率暂设为0%;进口环节增值税、消费税按法定应纳税额的70%征收。

For imported goods, the tariff rate is temporarily set at 0%. Value-added tax and consumption tax on import links are levied at 70% of the statutory tax payable.

报错

计算规则如下:

税费 = 购买单价 × 件数 × 跨境电商综合税率

跨境电商综合税率 =(消费税率 + 增值税率)× 70%

Error report

Calculation rules are as follows:

Tax fees= Unit Price * quantity * Comprehensive Tax Rate of Cross-border E-Commerce

Cross-border E-commerce Comprehensive Tax Rate=(Consumption Tax Rate+VAT Rate)*70%

举例:

进口清单中大部分商品是增值税16%,消费税0%,大致计算下来税率为16%×70%=11.2%,100元货值需要交纳11.2元的税。

Example:

Most goods in the import list are 16% VAT and 0% consumption tax. tax rate roughly calculated is : 16%*70%=11.2%, which means 11.2 yuan tax fee is subject to 100 yuan goods value. .

大黄蜂跨境解决方案

帮助企业快速实现合规的跨境零售方案

Bumblebee Technology‘s solutions for cross-border e-commerce enterprises

Help enterprises quickly achieve cross-border e-commerce compliance

从2019年起,是中国跨境零售B2C之元年,之前的擦边球做法(个人代购主体不合法,C2C个人物品量不大)都不能做了,合法的面向中国大陆消费者的跨境零售只能通过“网购保税进口”(海关监管方式代码1210)或“直购进口”(海关监管方式代码9610)两种方式运递进境。2019 is the first year of China's cross-border retail B2C, the previous practice(private overseas purchase on behalf is illegal, amount of C2C personal articles is small) . The legal cross-border retail for Chinese consumers can only be done through "online shopping bonded import" (Customs supervision code 1210) or "direct purchase import" (Customs supervision code 9610).

由于“直购进口”是由消费者在海外电商网站(如亚马逊平台或者海外企业自建平台)下单,这种方式由于物流速度慢、运费高、发生质量问题难于追责、清关速度慢等问题市场增量不会变化太多,或维持在一个较小量级。

“网购保税进口”受政策鼓励影响会出现蓬勃发展,目前全国37个保税区均已政策鼓励开展此业务。大黄蜂科技依靠多年的跨境电商服务经验,具有一揽子跨境电商服务解决方案,能够帮助跨境电商企业2019年快速实现“网购保税进口”业务流程,具体服务项目如下:”Direct purchase import” means consumers have to place order on overseas e-commerce websites (such as Amazon or self-built platform by overseas enterprises), this market increment will not change too much or remain at a small level due to slow logistics speed, high freight, difficult to recover quality problems, slow customs clearance and other problems.

"online shopping bonded import" will flourish under the influence of policy incentives. At present, 37 bonded areas in China are encouraged to develop this business. Based on years’ experience in cross-border e-commerce services, Bumblebee Technology has a package of cross-border e-commerce service solutions, which can help cross-border e-commerce enterprises quickly realize the business of "online shopping bonded import” in 2019. Our specific service are as follows:

1、帮助海外跨境电商企业建立本地电商服务企业;

2、帮助完成海关备案注册

3、帮助搭建面向C端顾客的基于公众号、小程序、app、H5的电商网站,顾客可直接在线支付下单,直接报关;

4、帮助完成三单推送,实现订单与海关打通,实时扣税,自动报关;

5、帮助完成订单与报税仓wms系统对接;

6、帮助实现合规结汇至海外跨境电商企业;

1. Help overseas cross-border e-commerce enterprises to establish e-commerce service company in China;

2. Help to complete Customs Registration

3. Help build e-commerce websites based on public numbers, mini programs, apps and H5 towards C-end customers. Customers can place and pay order online and declare customs directly.

4. Help to complete three-uniformity push, realize direct docking for order and customs clearance, real-time tax deduction, automatic customs declaration;

5. Help to complete docking between the order and the WMS system of tax declaration warehouse;

6. Helping to achieve compliant remittance to overseas cross-border e-commerce enterprises.

基于以上服务,将大大缩短跨境电商企业在国内开展网购保税进口的业务周期,大大降低成本,快速开展面向中国大陆消费者的零售业。最终实现的目标是:海外跨境企业只需要海外批量发货,从保税区接收货物开始,到消费者收到货物,再到资金结汇至海外账号,中间流程不需要商家重点关注,均由我们的相关服务承载。

Based on the above services, it will greatly shorten the process cycle and cost for cross-border e-commerce enterprises to rapidly carry out “online shopping bonded imports” in China, our ultimate goal is: The only thing for overseas cross-border enterprises need to do is to ship bulk orders from your side, we will undertake all relevant intermediate services including receiving goods in the bonded area, deliver goods to consumers, payment transfer to your overseas accounts, the intermediate process would not require too much of your focus.

专业 快 速 成本低 合法合规

Professional, Fast, Low cost, Legal compliance

如果你是跨境商家

你需要2019合法合规的跨境方案,请联系我们在线专家咨询

If you are a cross-border business

You need a 2019 legal cross-border business solution, please contact us:

Scan wechat to contact微信扫描联系

如果你是清关公司或者保税仓服务商

我们有大量的客户需要清关和仓储服务,请联系我们合作

If you are a customs clearance provider or bonded warehouse service provider

We have a large number of customers who need customs clearance and warehousing services. Please contact us:

Scan wechat to contact微信扫描联系

北京大黄蜂信息科技有限公司

从事电商SAAS服务的软件服务商,主要服务于淘宝商家,微信商家等。

自主研发的大黄蜂微信小程序,广泛适用于线上线下各行各业,支持线

大黄蜂科技 下实体企业进行线上下线融合。

Bumblebee Technology 地址:北京市政达路北方中惠国际D座602

电话:010-57796867

Email:service@dhfeng.com

Beijing Bumblebee Info Technology Co., Ltd.

Software service provider engaged in e-commerce SAAS services , mainly serve Taobao merchants, Wechat merchants,etc.

Our Bumblebee Wechat mini program is widely applicable to online and offline business and support online and offline business convergence

Address: Block D 602, Beifang Zhonghui International, Zhengda Rd, Beijing

Telephone: 010-57796867

Email:service@dhfeng.com